Nighthawk Gold (TSX: NHK)

Gold Resources Jump By 121% In Indicated & 1,400% In Inferred Categories

NIGHTHAWK GOLD (TSX: NHK) REPORTS SUBSTANTIAL EXPANSION OF 121% IN THE INDICATED CATEGORY AND 1,400% IN THE INFERRED CATEGORY IN PIT-CONSTRAINED MINERAL RESOURCE OUNCES; RE-ENVISIONING THE DISTRICT AS A POTENTIAL LARGE-SCALE OPEN-PIT PROJECT

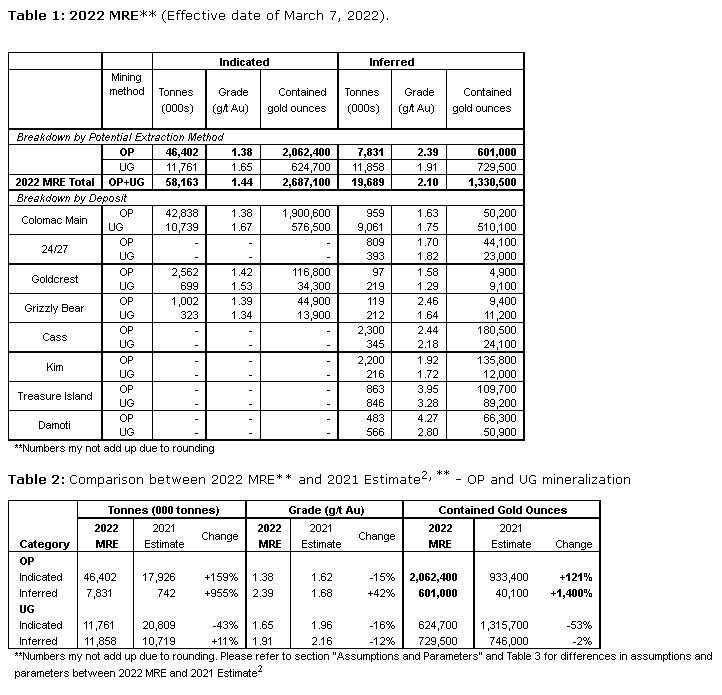

Nighthawk Gold (TSX: NHK) has released an updated mineral resource estimate on its 100-per-cent-owned, district-scale Indin Lake gold property, located 200 kilometres north of Yellowknife, NWT, Canada. The 2022 MRE (refer to attached table for a summary) demonstrates a substantial expansion in pit-constrained (OP) mineralization compared with the estimates reported in 2021 and the potential for a future large-scale, higher-grade, open-pit project in the district.

Highlights:

- 2022 MRE demonstrates a significant increase in potential OP Mineral Resource ounces (see Table 2):

- OP Indicated mineral resource estimates increased 121% to 2,062,400 gold ounces compared to the 2021 Estimate2 of 933,400 gold ounces, reflecting a decrease in the estimated average grade to 1.38 grams per tonne gold ("g/t Au") as compared to 1.62 g/t Au for the 2021 Estimate2

- OP Inferred mineral resource estimates increased 1,400% to 601,000 gold ounces compared to the 2021 Estimate2 of 40,100 gold ounces, reflecting an increase in the estimated average grade to 2.39 g/t Au as compared to 1.68 g/t Au for the 2021 Estimate2

- 2022 MRE demonstrates a significant increase in the Global (potential OP + Underground "UG")) Mineral Resource ounces:

- Global Indicated mineral resource estimates increased 19% to 2,687,100 gold ounces compared to the 2021 Estimate2 of 2,249,100 gold ounces, reflecting a decrease in the estimated average grade to 1.44 g/t Au as compared to 1.81 g/t Au for the 2021 Estimate2

- Global Inferred mineral resource estimates increased 69% to 1,330,500 gold ounces compared to the 2021 Estimate2 of 786,100 gold ounces, reflecting a slight decrease in the estimated average grade to 2.10 g/t Au as compared to 2.13 g/t Au for the 2021 Estimate2

- 2022 Exploration Program: The Company plans to commence drilling in May and is currently mobilizing supplies and preparing the site for drilling. Drilling will prioritize the higher-grade targets including Kim & Cass, Damoti, and Treasure Island and will consider other grassroots opportunities.

Keyvan Salehi, President & CEO commented: "We are extremely pleased with the results of the updated 2022 MRE, which exceeded our own expectations. The shift in our strategy early last year towards higher-grade, pit-constrained mineralization, combined with a much more accelerated and aggressive approach towards exploration, have resulted in a significant expansion in the OP mineral resource estimates at our property. We have successfully increased our OP mineral resource estimates to approximately 2.1 million ounces in the Indicated category and 0.6 million ounces in the Inferred category. After evaluating all the data and working towards a future conceptual mine plan, we believe that the scalability of the project to a potentially robust, large open-pit operation, far outweighs the marginal decrease in overall OP grades compared to the 2021 Estimate. With just over 72,000 metres of drilling completed last year, our current evaluations and consideration of the project benefit tremendously from the extensive information received from our 2021 drill campaign."

"We are particularly excited about the contributions of higher-grade, near-surface mineralization from the Kim & Cass, Damoti, and Treasure Island deposits. These four deposits combined represent approximately 0.5 million ounces grading 2.62 g/t Au of Inferred estimated mineral resources in the 2022 MRE. These higher-grade deposits remain open along strike and at depth providing an opportunity to further enhance the global mineral resource estimated grades with additional drilling. Our 2022 exploration program will focus on expanding higher-grade mineralization, whilst continuously looking at the entire property for additional higher-grade targets and long-term opportunities. We look forward to providing timely updates on our 2022 exploration program and other developments."

2022 MRE

The 2022 MRE benefits from 39,065 metres ("m") of drilling information from the 2021 and 2020 (drill data that was not included in the 2021 Estimate2) exploration programs. Mineral resource expansion drilling in 2021 was principally on-strike of the deposits, to increase drill density in areas where drill data was limited and to test the lateral extent of smaller deposits. The 2022 MRE is comprised of nine (9) deposits. Five (5) deposits are located within the Colomac Centre (Colomac Main, Goldcrest, Grizzly Bear, 24 and 27). The remaining four (4) satellite deposits are located between 11 km to 28 km from the Colomac Centre (Kim, Cass, Damoti, and Treasure Island) and demonstrate typically higher-grade OP mineralization compared to the deposits within the Colomac Centre (please refer to Figure 1 for a regional map of the Indin Lake Gold Property). The Damoti Deposit was re-evaluated as a potential OP deposit in the 2022 MRE (it was considered a potential UG deposit in the 2021 Estimate2) due to the proximity of the known mineralization to the surface and land access. Please refer to Figures 2, 3, 4, 5, and 6 for the mineral resource estimate longitudinal section views of the Colomac Main, Cass, Kim, Damoti Lake, and Treasure Island deposits, respectively.

The 2022 MRE was generated using various cut-off grades: Between 0.50-0.63 g/t Au for potential OP mineralization (depending on the deposit) and 1.02-1.83 g/t Au for the potential UG mineralization (depending on the deposit and UG extraction - bulk or selective). Specific extraction methods are used only to establish reasonable cut-off grades for various portions of the deposits. No Preliminary Economic Analysis, Pre-Feasibility Study or Feasibility Study has been completed to support economic viability and technical feasibility of exploiting any portion of the mineral resources, by any specified mining method. The reasonable prospect for an eventual economical extraction is met by having used reasonable cut-off grades both for a potential OP and UG extraction scenarios and constraining volumes (Deswik shapes and optimized pit-shell).

Assumptions and Parameters

The 2022 MRE includes a few assumptions and parameters that are different compared to the 2021 Estimate2. Please see Table 3 for a summary of the assumptions and parameters for the 2022 MRE and 2021 Estimate2. Due to the significant expansion in the potential OP mineralization at Colomac Centre and the satellite deposits, the Company and its independent consultants believe that there is potential for a future, large-scale, OP operation at its properties. A potential large-scale OP operation would entail lower cost per tonne assumptions, which resulted in a lower estimated OP cut-off grade range in the 2022 MRE compared to the 2021 Estimate2. In addition, the lower cut-off grades in the 2022 MRE resulted in a larger amount of mineralized blocks above the cut-off grade and a slight decrease in average grades compared to the 2021 Estimate2. The larger amount of mineralized blocks above the cut-off grade provides more flexibility to build an optimal conceptual mine plan in the future.

2022 Exploration Program

The Company is currently evaluating the 2022 MRE and finalizing the 2022 Exploration Program. The 2022 Exploration Program will be carried out in a phased approach and will focus on expanding the potential OP mineralization of the higher-grade deposits, particularly Kim, Cass, Damoti, and Treasure Island.

Disclaimer: Nighthawk is a paid marketing client*

Have feedback on this article? Concerned about the content?

Get in touch with us directly Alternatively, email suneal@thegoldstocks.com

The Gold Stocks website (www.thegoldstocks.com) is owned by Machai Capital. Machai is a Vancouver, British Columbia-based marketing, advertising, and public relations company. Our writings are not designed to provide financial advice. It is not an advice to buy or sell any stock, and it does not take into consideration your objectives or financial position.

Address: 200-17618 58 Ave, Surrey, BC, V3S1L3.